Importing custom wheels can be a financial puzzle. High duties can slash your profits, while unexpected customs fees can turn a good deal sour. Many wheel shops struggle to predict their true landed costs.

To calculate import duties for custom wheels, multiply the CIF value (Cost, Insurance, Freight) by the applicable duty rate for your country. For example, in the USA, forged wheels typically face a base duty rate plus potential Section 301 tariffs if imported from China.

As a forged wheel manufacturer exporting globally, I've seen firsthand how customs duties can make or break a wheel importing business. Let me share what I've learned from shipping our TreeWheels custom forged wheels to markets around the world, and how you can navigate this complex landscape.

How to Calculate Import Customs Duties?

Customs charges are the hidden costs that catch new importers by surprise. I've had clients call in panic when their wheels were held at customs, facing unexpected fees that threatened their profit margins.

To calculate import customs duties correctly, start with the customs value (usually CIF - Cost, Insurance, and Freight), identify the correct HS code for your wheels, apply the corresponding duty rate, and add any special tariffs or fees specific to the importing country.

From my experience shipping high-end forged wheels to international clients, the customs calculation process can vary dramatically between countries. The basic formula looks simple, but numerous factors can complicate things. For example, wheels exported to the USA from China typically face specific tariff rates based on material composition and intended application.

| Wheel Type | Production Time | Typical HS Classification |

|---|---|---|

| One-Piece Forged | 15-20 days | 8708.70.6060 |

| Two-Piece Forged | 20-25 days | 8708.70.6060 |

| Three-Piece Forged | 30-35 days | 8708.70.6060 |

Our one-piece, two-piece, and three-piece forged designs may each fall under slightly different HS classifications, affecting the applicable duty rates. Many of our customers don't realize that even the specific alloys used in our wheels can impact classification and duty rates.

One key advantage we offer at TreeWheels is our DDP (Delivered Duty Paid) shipping options for both sea and air freight. This means our clients don't need to handle customs clearance or pay import duties themselves. We have established channels in destination countries to manage the import process smoothly, essentially building the duty costs into our shipping fees. From years of experience, I've observed that most clients prefer our DDP sea freight option. Although shipping takes 15-30 days depending on the destination country, with proper planning, our production time plus sea freight is comparable to local production timelines. Most importantly, our clients end up with a significantly lower landed cost compared to sourcing locally.

What is the Formula for Import Duty?

The seemingly simple import duty calculation often becomes the breaking point for wheel businesses. I've watched competitors miscalculate duties by thousands, destroying their margins.

The standard import duty formula is: Duty Amount = Customs Value (usually CIF) × Applicable Duty Rate. However, this basic formula often expands to include additional charges such as anti-dumping duties, countervailing duties, and processing fees.

Beyond the basic calculation of (CIF value × duty rate), there are numerous fees and charges that make up the true landed cost of imported wheels. Based on our extensive experience shipping to various international markets, I've found that many wheel importers fail to account for processing charges, harbor maintenance fees, merchandise processing fees, and sometimes even anti-dumping duties that apply specifically to automotive parts from certain countries.

| Fee Type | Typical Rate | Applies To |

|---|---|---|

| Base Duty | 2.5%-3.9% | CIF Value |

| Section 301 Tariff (USA) | Up to 25% | CIF Value |

| Merchandise Processing Fee (USA) | 0.3464%-0.3481% | Entered Value |

| Harbor Maintenance Fee (USA) | 0.125% | Value for Sea Shipments |

The formula becomes even more complicated when accounting for preferential trade agreements. For example, wheels qualifying under certain free trade agreements might face reduced or zero duties, but require specific documentation to prove origin. At TreeWheels, we work closely with our B2B clients to ensure proper documentation and classification to avoid unexpected charges.

Section 301 tariffs have become a major consideration for our US clients, adding substantial costs to wheel imports from China. These additional duties can significantly impact the final landed cost, which is why many of our customers appreciate our ability to manage these complexities through our DDP service. By building these costs into our pricing structure, we provide transparency and predictability that wheel retailers need for proper business planning.

What is the Duty Rate for Import to the USA?

USA duty rates can shock unprepared wheel importers. I've consulted with shops who budgeted for 3% duty, only to discover the true rate was much higher due to additional tariffs.

The base duty rate for imported aluminum wheels to the USA typically ranges from 2.5% to 3.9% depending on classification. However, wheels from China may also face Section 301 tariffs of up to 25%, potentially bringing the total duty rate to nearly 30%.

s for custom wheels USA import [duty rate](https://www.cbp.gov/trade/programs-administration/determining-duty-rates)s for wheels](https://treewheels.com/wp-content/uploads/2025/08/image-4-usa-customs-duty-rates-for-custom-wheels-.png)

The USA has one of the more complex duty structures for wheel imports, particularly for products originating from China. At TreeWheels, we've been navigating these waters for years, helping our B2B partners understand the full import cost picture. The Harmonized Tariff Schedule (HTS) classifies most aluminum alloy wheels under code 8708.70, but specific classifications can vary based on design features and intended vehicle application.

| Country | Shipping Method | Typical Transit Time | DDP Service Available |

|---|---|---|---|

| USA | Sea Freight | 20-25 days | Yes |

| USA | Air Freight | 7-10 days | Yes |

| Canada | Sea Freight | 25-30 days | Yes |

| Australia | Sea Freight | 20-25 days | Yes |

| UAE/Dubai | Sea Freight | 15-20 days | Yes |

| UK | Sea Freight | 25-30 days | Yes |

What many wheel importers don't initially realize is that the base duty rate is just the starting point. Section 301 tariffs implemented in recent years have dramatically increased the total duty burden for Chinese-origin wheels. Additionally, there are Merchandise Processing Fees (MPF) which range from 0.3464% to 0.3481% of the entered value (with minimum and maximum fee amounts), and Harbor Maintenance Fees (HMF) of 0.125% on shipments arriving by sea.

This is precisely why our DDP shippingg options have become so valuable to our clients. By handling the customs clearance process ourselves through our established channels in destination countries, we effectively remove this complexity and uncertainty from our clients' operations. Our approach of building these costs into our shipping fees means clients can focus on their core business rather than becoming customs experts. Despite the added shipping time of 15-30 days for sea freight, most clients find that with proper planning, this approach results in significantly better pricing than local sourcing.

How to Calculate GST on Custom Duty?

GST/VAT calculations create an unexpected "tax on tax" situation. I've seen businesses forget this step, only to find their profit margins eroded by these secondary taxes.

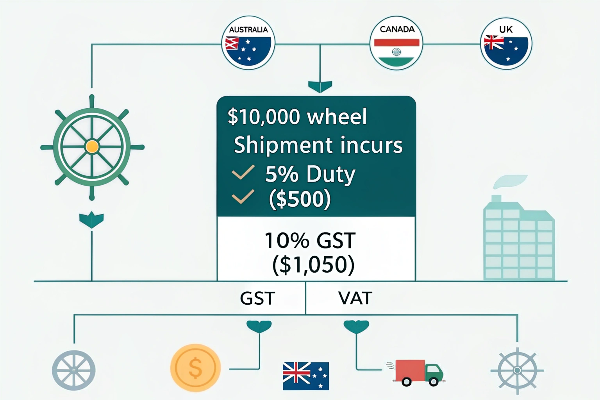

To calculate GST/VAT on imported wheels, apply the tax rate to the sum of the wheels' value plus the import duty already paid. For example, with a $10,000 wheel shipment facing 5% duty and 10% GST, you'd pay $500 in duty first, then $1,050 in GST (10% of $10,500).

Something we've learned through experience at TreeWheels: GST/VAT calculations usually come after the duty is calculated, essentially creating a "tax on tax" situation that increases the final landed cost. This is especially relevant for our Australian and Canadian clients where GST becomes a significant cost factor. In Australia, for instance, the 10% GST applies not just to the value of the wheels, but also to the duty amount already paid.

| Country | VAT/GST Rate | Calculation Base |

|---|---|---|

| USA | No federal VAT | N/A |

| Canada | 5% GST | CIF + Duty |

| Australia | 10% GST | CIF + Duty |

| UK | 20% VAT | CIF + Duty |

| UAE/Dubai | 5% VAT | CIF + Duty |

This cascading tax effect can significantly impact final costs. For example, when shipping our high-end forged wheels to Canada, the 5% GST applies to the combined total of the wheels' value plus the duty amount. This means even a small duty rate increase has an amplified effect on the final landed cost.

For many of our international clients, especially those in countries with higher VAT/GST rates like the UK (20%) or parts of Europe, understanding this calculation is crucial for accurate pricing. This is another area where our DDP service provides significant value. By handling both the duty and subsequent tax payments, we give our wheel retailer clients complete cost clarity from the beginning.

The benefit of our approach becomes clear when compared to local sourcing. Even with the combined impact of duties and taxes, our clients find that importing wheels through our DDP service results in substantially lower costs than purchasing locally manufactured alternatives of similar quality. With proper planning around our production times (15-20 days for one-piece forged wheels, 20-25 for two-piece, and 30-35 for three-piece designs) plus shipping (15-30 days via sea freight), our clients gain both cost advantages and exceptional product quality.

Conclusion

Understanding wheel import duties requires careful attention to duty rates, formulas, and country-specific regulations. With proper planning and the right partner, importing custom wheels can be both profitable and hassle-free. TreeWheels' DDP shipping options eliminate customs headaches while delivering premium forged wheels at competitive prices.